The nationwide picture – Have we fallen out of love with cash?

We are witnessing rapid change in the way people choose to pay. Each year, cash payments see a decrease while both card and mobile payments soar. It is affecting every industry. We have seen this with the rise of completely cashless vending machines. There are three main drivers for this change, according to UK Finance;

- Changing Consumer Preferences

- Technological Developments

- Innovations in payment methods

It is no secret that society is moving away from cash. The summer of 2017 saw card payments overtake cash as the UK’s number one payment method. In 2006, cash was the chosen payment method with 62% of all purchases. Last year, the percentage dropped to 40%.

The digital revolution has had a massive impact. Smartphone development, contactless payment solutions, online banking and online shopping are all factors encouraging people to turn their backs on cash. We have embraced a cashless society due to its convenience and ease. In the past, cards were used for higher purchases, and cash for lower. This was partly due to card fees which have now been abolished. Gone are those days, now we choose to buy our coffee or lunch with our cards too. The other factor aiding the move towards card payments is the ease and popularity of tap and go (contactless). Much simpler to pull out a card and tap a reader, than to count cash.

Contactless has become the trend

When contactless cards were first introduced a decade ago, they were met with anticipation. People were reportedly concerned about data privacy and the risks associated with cards being stolen. These thoughts soon faded with contactless now making up nearly half of all card purchases. A sharp rise from 1 in 10 back in 2015. The contactless or ‘tap and go’ option is used for a variety of payments including, groceries, train tickets, clothes or even a beer. World Pay released figures based on payments in UK stores and small businesses. They found that contactless had even overtaken traditional chip and pin.

The growth of contactless started in London. The underground adopted contactless payment systems back in 2014. This introduction was an early driving force of the contactless revolution. Consumers love for contactless did not happen as quickly as some hoped with merchants reluctant to spend money on upgrading their card readers. Even some of the biggest supermarkets only introduced contactless readers in 2016.

Fast-forward to 2018 and we can pay by contactless everywhere. The UK is at the forefront of the contactless revolution, from the corner shop to the bus. Contactless is quicker for both consumers and retailers. For consumers, it is simply convenience. For retailers, quicker payments mean queues move faster and they can serve more customers. This is also true of course for cashless vending machines.

By the end of 2017, 78% of debit cards and 62% of credit cards were contactless. And, an impressive 63% of people in the UK now use contactless cards.

Mobile payments aren’t far behind

As well as physical contactless cards, another way to pay that has entered the market – Mobile payments. This means that all people need to leave the house with is a phone. In particular, this method has been adopted by younger consumers. Apple Pay, Samsung Pay and Android Pay let users easily and securely store card details on their smartphones. Eliminating the need for a purse/wallet. Barclay Card recorded a massive 90% increase in-app payments in 2017. Currently, mobile payments are used the least often, but forecasts suggest they will continue to grow in popularity. Spending via smartphone is accelerating. In fact, according to World Pay, a third of customers now take advantage of their smartphone payment capabilities.

Doozy evidence – the proof is in the case study

We decided to delve into Doozy’s data to see how cash vs card stacks up for our vending machines. The data is from our machines across three different sectors, healthcare, education and leisure.

We decided to delve into Doozy’s data to see how cash vs card stacks up for our vending machines. The data is from our machines across three different sectors, healthcare, education and leisure.

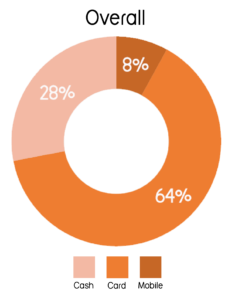

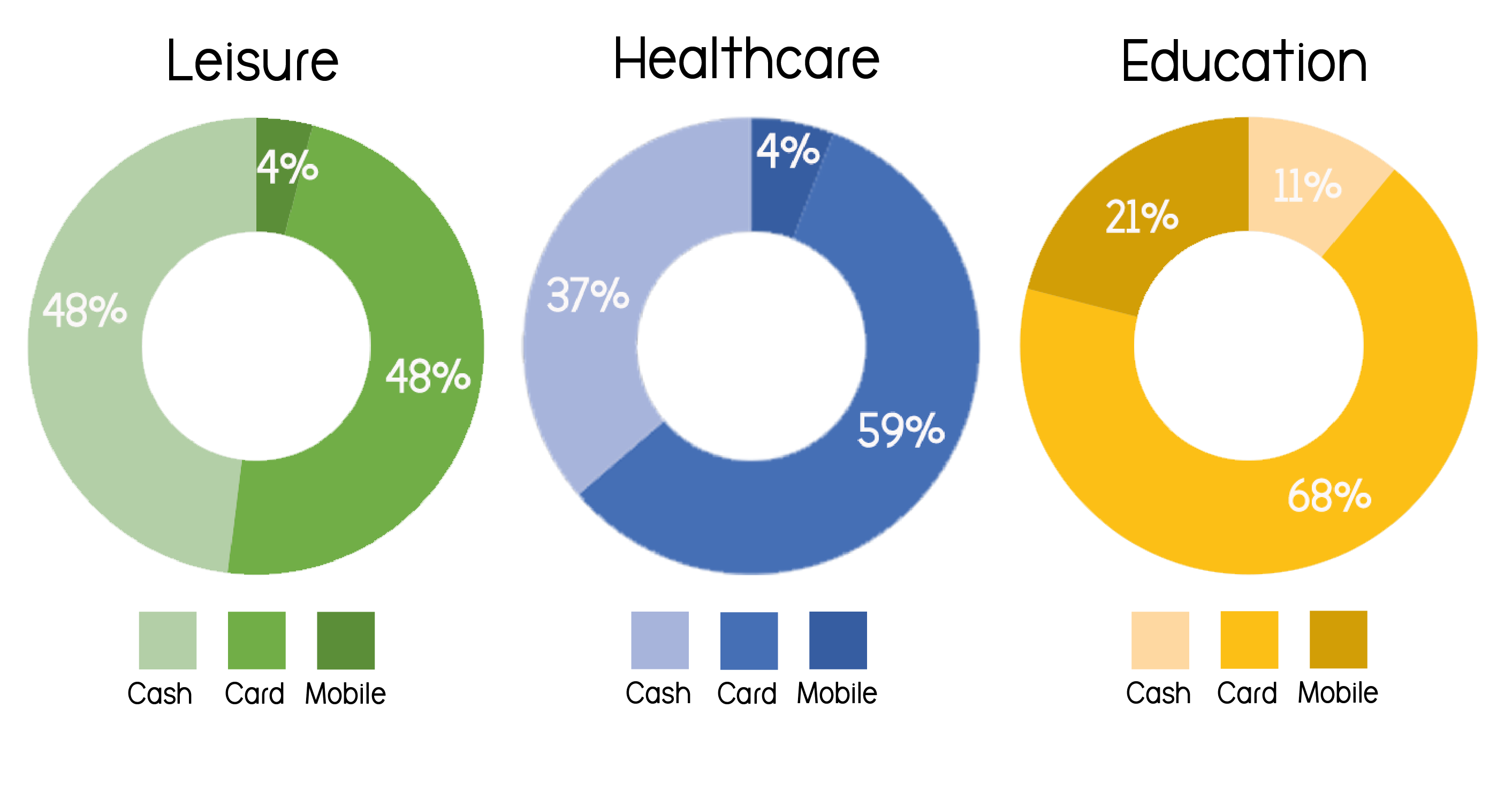

Trends across the UK show that card has overtaken cash as the main payment method. Our overall stats reflect this. 64% of our customers across all sectors paid with a card, and a further 8% with mobile. It is worth noting that people use a card through their mobile app to pay, taking the total card payments to 72%.

The results became interesting when splitting the data into sectors. While both the education and healthcare sectors showed over half paying by card, the leisure results painted a different picture. Including both card and mobile app payments, the leisure sites took 52% card payments, only just ahead of cash. We expected to see a bigger difference. The education sector was streets ahead with most students and staff opting to pay with a card. Just a small amount opted for cash, 21%. Of course, this is the sector with consumers mostly below 30. It is expected younger people will choose card over cash.

The mobile payment percentage showed this age difference as well. Consumers at healthcare and leisure sectors are a variety of ages, from children to elderly. Each of these sectors had 4% of people use a mobile payment app, but for education, this figure jumped to 11%. Across all sectors, we see 8% of people using mobile apps currently. Yet if current predictions are correct, this number will rise over the next decade.

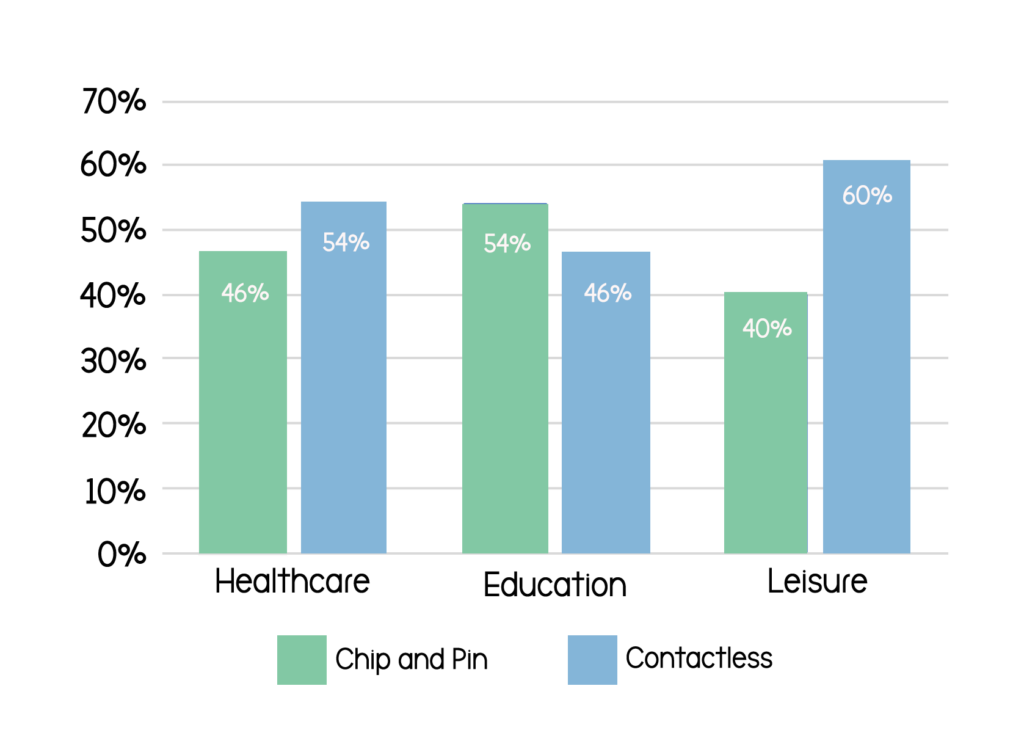

We split the card percentages up to see the difference between contactless and chip and pin. The figures were unexpected. The leisure sector, who had much lower card payments than expected, also had more contactless payments. Although healthcare had a closer percentage of people using contactless, more consumers opted to use it over chip and pin. Education was the only sector in which contactless was used less than chip and pin. Consumers in the education sector much prefer to use card, and yet showed a slight increase in chip and pin payments. This is unusual as results show that younger consumers favour chip and pin.

The benefits of completely cashless vending machines

There are still people who choose to spend with cash. However, there are far more benefits to having completely cashless vending machines, including;

To meet the demand

One thing is for sure. Consumers are carrying less cash and are more inclined to spend money on card. Therefore, it makes sense to offer this option. Although only a small percentage choose to pay via mobile, this is expected to rise considerably.

Providing Service

As a vending company, we occasionally have issues with our machines. When products fail to vend, it is very easy to refund consumers who pay on card. Of course, with no constant staff on site, refunding by cash is more problematic.

Speed

The speed to pay by contactless offers consumers a much faster and more convenient purchase. Without the need of digging through their pockets looking for change, they can simply tap and pay.

It is predicted that by as soon as 2026, cash payments will fall to 21%. It is now time to make the switch. We need to adapt to buying trends to stay ahead of the game. For us, this means our vending machines need to be equipped for the future. At the very least, every single vending machine should be fitted with a card reader. We have seen entire sites convert to completely cashless vending machines. Our Doozy card machines are powered by Nayax. They have seen growing numbers of machines needing card readers.

“The use of cashless payments has long reached the tipping point and it is foolhardy for vending operators and other unattended machine owners to ignore this trend. Consumers are drawn to the convenience of paying by their preferred method of choice, while operators benefit from increased sales and improved productivity. Integrating Nayax’s cashless payment solution can see revenue increase up to 30%, and enable flexibility in pricing that is not available when paying with cash.” Lewis Zimbler, Managing Director, Nayax UK.

If you would like completely cashless vending in your organisation, contact us today.

Say hello

Get in touch or come for a visit